41+ charitable remainder unitrust calculator

Web Flip Unitrust. Ad Supporting charitable giving since 1999.

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Specify whether the trust lasts for a term of years a single life expectancy or a joint life expectancy up to five ages.

. Web Tools Resources. Web Charitable Remainder Unitrust Calculator. Web The most popular and flexible type of life income plan is a charitable remainder unitrust CRUT.

Web Charitable remainder unitrusts continued to be the most common split-interest trusts accounting for more than three-quarters 803 percent of returns filed in. Web Upon establishing a charitable remainder unitrust you are entitled to a current income tax deduction for a portion of the value of the gift transferred to the trust which is often. Web Charitable Remainder Unitrusts CRUTs can be beneficial in certain instances.

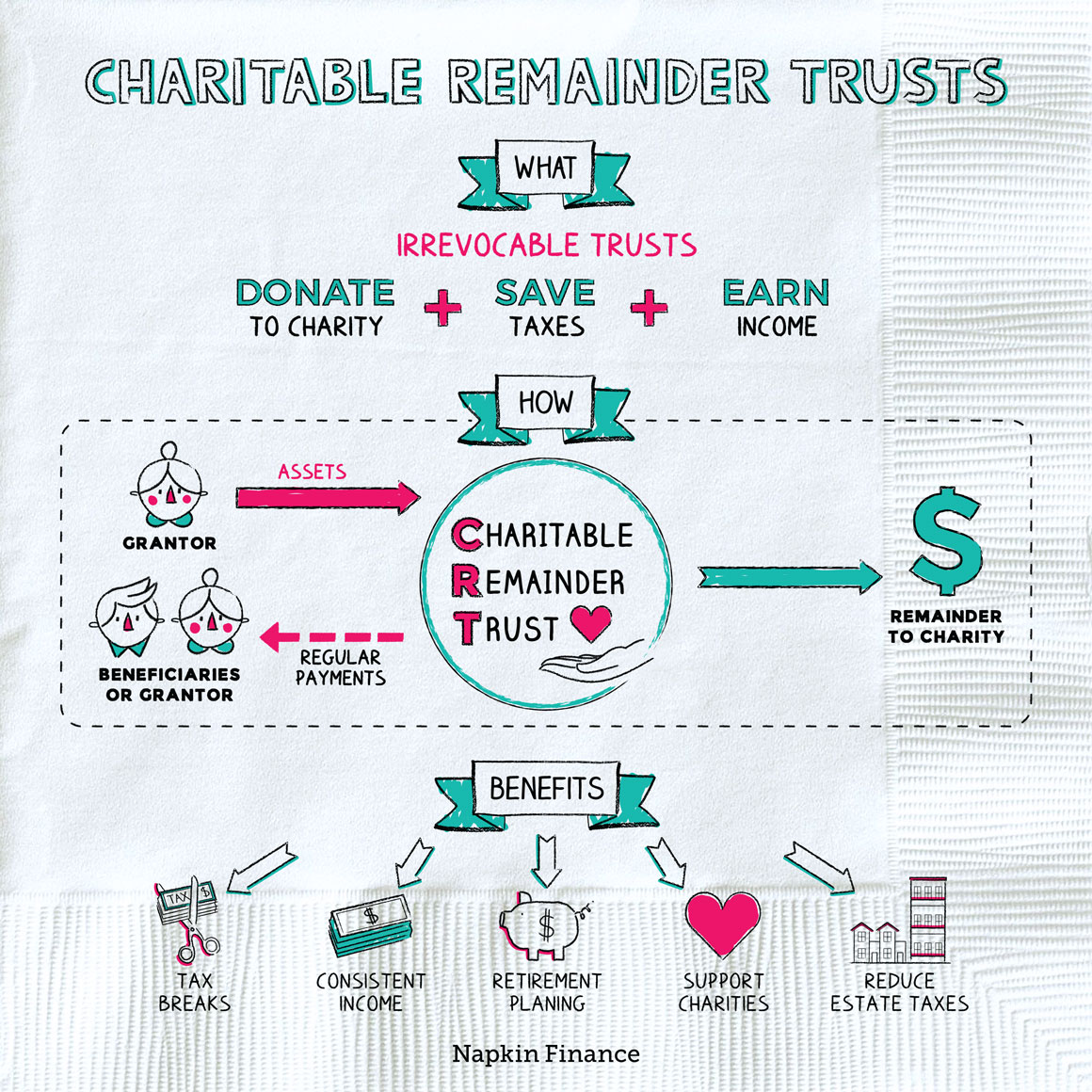

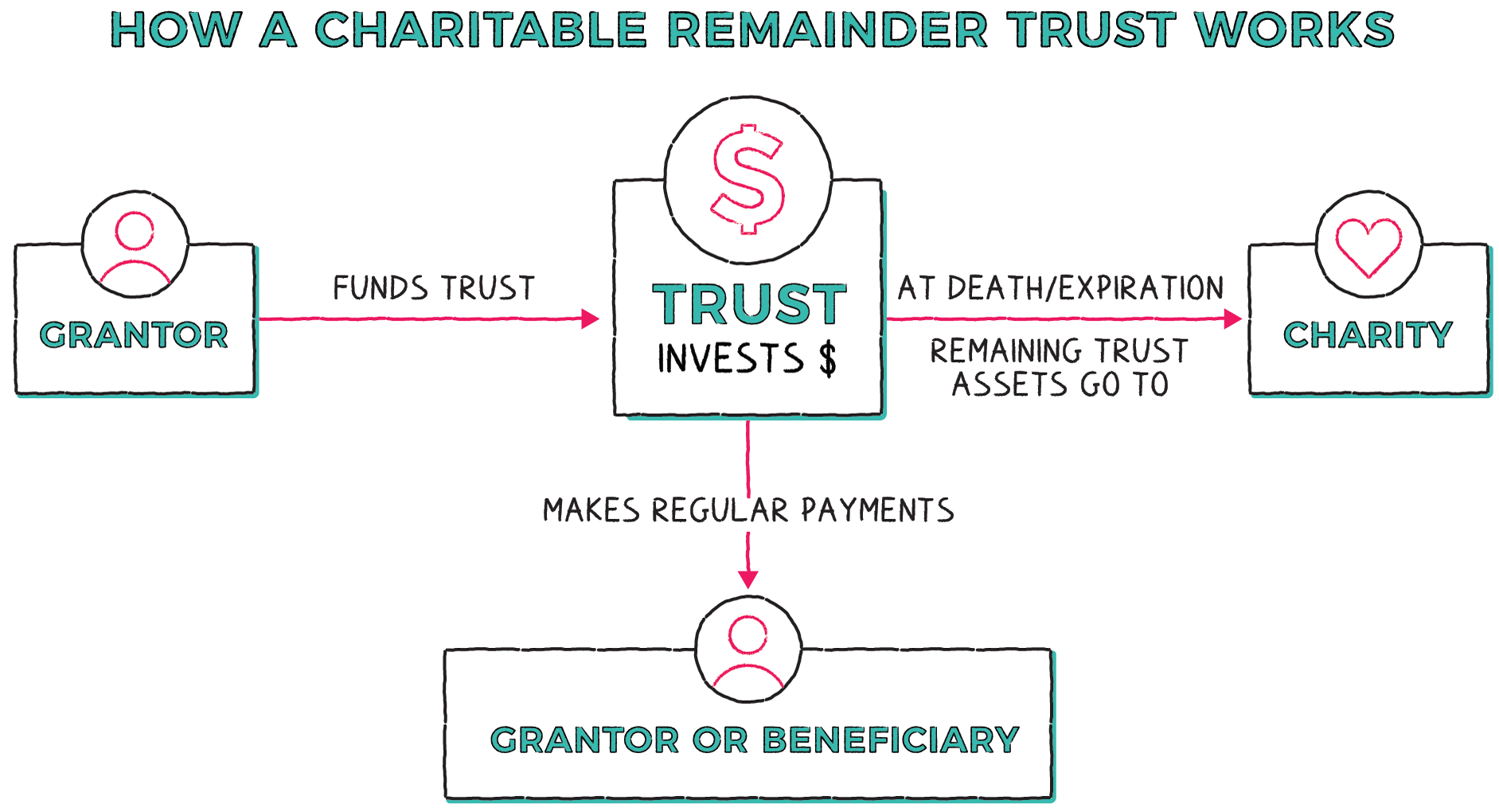

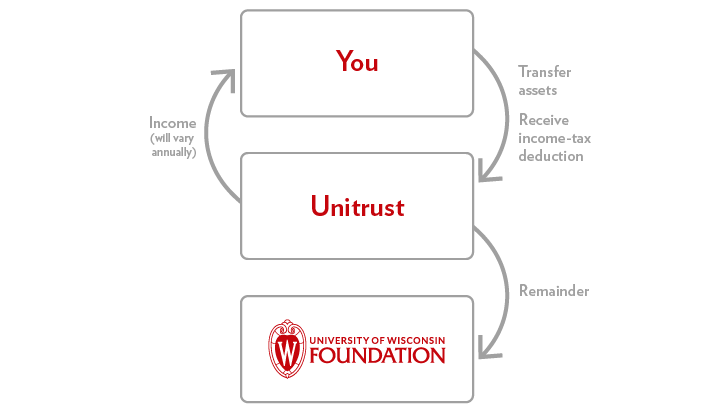

Provides the method of computing the Adjusted Payout Rate given the trusts stated payout rate and the section 7520 interest. A donor transfers property cash or other assets into an irrevocable trust. Cash securities real property or other assets are transferred into the trust.

The donor or members of the donors family are usually the initial beneficiaries. The trust provides variable income to the beneficiary. This calculation determines the donors deduction for a contribution to a charitable remainder unitrust.

Web In a charitable remainder trust. It also calculates the deduction as a percentage of the amount transferred. A flip charitable remainder unitrust unitrust is a gift plan defined by federal tax law that allows a donor to provide income to herself andor others while making a generous gift to charity.

Web Charitable Remainder Unitrust Calculator. Theyre a tax-exempt Irrevocable Trust meaning they cannot be changed set up with the. Web Main Menu Name.

Web A charitable remainder unitrust also called a CRUT is an estate planning tool that provides income to a named beneficiary during the grantors life and then the remainder of the trust to a charitable cause. Contribute cash securities or appreciated non-cash assets. A great way to make a gift to the Foundation receive fixed payments and defer or eliminate capital gains tax.

Web Home Ways to Give Plan Your Legacy Giving That Provides Income Charitable Remainder Trust Charitable Remainder Trust Gift Calculator. The trusts basis in the transferred assets is carryover. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Web Charitable Remainder Annuity Trust Calculator. The income may continue for the lifetimes of the beneficiaries a fixed term of not more than 20 years or a combination of the two. A great way to make a gift to the American Cancer Society receive payments that may increase over time and defer or eliminate.

The choice of payment frequency does affect the amount. Web Income Charitable Remainder Unitrust. Local Estate Planning or Estate Settlement Representative.

Get Access to the Largest Online Library of Legal Forms for Any State. Web Select either monthly quarterly semiannual or annual income payments to the beneficiaryies of the income. A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or.

Learn how to maximize your impact.

Charitable Remainder Trust Calculator

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Charitable Remainder Trusts Planned Giving Design Center

Charitable Remainder Trusts Planned Giving Design Center

Pdf Evidence On The Main Factors Inhibiting Mobility And Career Development Of Researchers

Charitable Remainder Trusts Planned Giving Design Center

Is A Charitable Remainder Trust Right For You Napkin Finance

Free 41 Budget Forms In Pdf

Contents Vol I Interviewers Instructions Part 1 Esds

Charitable Remainder Trusts Crt Frequently Asked Questions

Is A Charitable Remainder Trust Right For You Napkin Finance

Proceedings Of The Lake Malawi Fisheries Management Symposium

Charitable Remainder Trusts Barnabas Foundation

Charitable Remainder Unitrust University Of Virginia School Of Law

Atlantis Playtest V1 0 Pdf Role Playing Games Gaming

Charitable Remainder Trust Calculator Jcf Montreal Jewish Community Foundation Of Montreal

Charitable Remainder Unitrust University Of Wisconsin Foundation